Identifying and Interpreting a Spinning Top Candlestick

Curious about spinning top candlesticks? These unique patterns in technical analysis reveal moments of market indecision, offering traders clues about potential price movements. By understanding and recognizing spinning tops, you can gain insights into market sentiment and enhance your trading strategy. Ready to dive in and learn more about this intriguing candlestick pattern? Explore the Spinning Top Candlestick pattern and its nuances with expert insights from Trade 2.0 Avapro, connecting investors with educational experts.

Deciphering the Spinning Top Candlestick

A spinning top candlestick is a small-bodied candlestick pattern with long upper and lower shadows. This candlestick shows a situation where neither buyers nor sellers could gain the upper hand. The small body suggests a close price near the opening price, indicating indecision in the market. The long shadows on either side show that prices moved significantly up and down during the session, but the market couldn’t commit to a clear direction.

To spot a spinning top, look for a candlestick with a body that’s about the same length as its shadows. These can appear in any time frame, from one-minute charts to monthly charts. Traders often see spinning tops in both uptrends and downtrends, serving as a potential reversal indicator. For example, if you notice a spinning top after a series of bullish candlesticks, it might mean that the buying pressure is waning, and sellers could be taking control.

Would you recognize a spinning top in your own trading? Check your charts for this pattern and see how it aligns with your current analysis. As with any pattern, it’s important to confirm its signals with other technical indicators before making a trading decision.

Psychological Interpretations of Spinning Top Patterns

The spinning top candlestick reflects a market state where traders are uncertain. When you see this pattern, it indicates that neither buyers nor sellers have enough conviction to push the price decisively in one direction. This tug-of-war results in a small body with long wicks, symbolizing the highs and lows reached during the session.

Imagine a spinning top candlestick as a balance scale. Both sides weigh the same, so the scale remains level. In a trading context, this balance suggests that the market participants are equally matched. This often happens when traders are waiting for more information before making their next move. For instance, before a major economic announcement, you might see several spinning tops as traders hesitate to commit.

Have you ever felt stuck in making a decision? That’s the market’s state during a spinning top. Understanding this psychological aspect can help you interpret the broader market sentiment. Remember, though, a spinning top alone doesn’t guarantee a market reversal or continuation. Use it as a clue in conjunction with other analysis tools to get a clearer picture.

Spinning Top Candlestick in Different Market Contexts

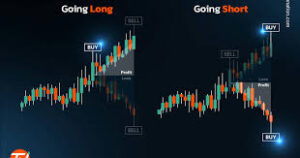

The context in which a spinning top candlestick appears is crucial for its interpretation. In an uptrend, a spinning top might suggest that the upward momentum is losing strength. Traders might view this as a potential sign of a trend reversal or a pause in the uptrend. Conversely, in a downtrend, a spinning top can signal that selling pressure is easing and buyers might start to step in.

Consider a market in an uptrend for several weeks. You spot a spinning top. This could indicate that buyers are hesitant to push prices higher without further confirmation. It’s a good time to look at other indicators, like volume or momentum, to see if they support the possibility of a reversal.

In sideways markets, spinning tops are more frequent. They indicate ongoing indecision among traders. In such scenarios, it’s often best to wait for a breakout in either direction before taking a position. For instance, if the price has been bouncing within a range, a spinning top followed by a strong move can indicate the direction of the breakout.

Have you ever wondered how context affects your trading decisions? The spinning top’s message changes based on where it appears. Always consider the broader trend and market conditions when interpreting this candlestick.

Spinning Top Variations and Their Implications

There are different types of spinning tops, each with its own implications. The long-legged spinning top, for instance, has even longer shadows than the standard spinning top. This pattern indicates even more significant indecision and greater price volatility within the session. It can be a more powerful signal of a potential reversal when it appears at market extremes.

Comparing spinning tops to other candlestick patterns can also be insightful. A doji, for example, also shows indecision but typically has no real body, meaning the open and close prices are the same. While both suggest a lack of conviction, a doji might indicate a stronger sense of uncertainty.

Consider the scenarios you’ve encountered in your trading. How did different spinning top variations affect your analysis? For instance, if you see a long-legged spinning top after a strong uptrend, you might take it as a stronger sign of a potential reversal than a regular spinning top.

Conclusion

Understanding spinning top candlesticks can be a game-changer in your trading arsenal. These patterns offer valuable insights into market indecision, helping you make more informed decisions. Always consider the broader context and use additional indicators to confirm signals. Want to master your trading skills? Keep learning and stay connected with financial experts for the best advice.