The Tether Boom in the Crypto World

In the ever-shifting terrain of cryptocurrencies, there exists a digital asset that has carved a path of dominance, commanding the spotlight and captivating the curiosity of both fervent supporters and discerning critics. For example, Tether (USDT) often at the epicenter of debates surrounding stability and transparency, has managed to assert its influence in the crypto-verse. Its journey, riddled with controversies and innovations, encapsulates the dynamic nature of the digital asset realm.

Keep reading to embark on an exploration of the enigmatic Tether (USDT), unraveling the intricate phenomenon that has catapulted it into the echelons of the crypto realm’s formidable forces.

Understanding Tether: A Stablecoin Marvel

Tether, denoted as USDT, belongs to a unique category of cryptocurrencies known as stablecoins. Unlike traditional cryptocurrencies like Bitcoin and Ethereum, stablecoins are designed to maintain a stable value, often pegged to a fiat currency, such as the US dollar. In the case of Tether, the value of one USDT token is intended to be equivalent to one US dollar.

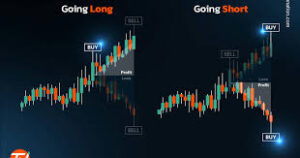

This inherent stability has made Tether an essential tool for traders and investors within the volatile world of cryptocurrencies. Traders often use Tether as a safe haven during market downturns, allowing them to swiftly convert their holdings into a stable asset, preserving their capital.

The Tether Boom: Why It’s Gaining Prominence

Several key factors have contributed to the Tether boom:

- Risk Mitigation: Cryptocurrency markets are notorious for their price volatility. Tether provides a means for traders to park their assets in a stable value when they anticipate market turbulence. This risk mitigation feature has made Tether an invaluable asset in the crypto world.

- Liquidity and Trading Pairs: Tether is widely adopted as a trading pair on numerous cryptocurrency exchanges. Many cryptocurrencies are traded against Tether, facilitating easier conversions and trading. This ubiquity has made Tether an essential part of the trading ecosystem.

- Fiat Onramp: Tether serves as a bridge between traditional financial systems and the crypto space. Traders and investors can easily convert fiat currencies into Tether and vice versa, providing a smooth onramp into the world of cryptocurrencies. For businesses managing large-scale transactions or recurring settlements, having a crypto business account streamlines access to stablecoin infrastructure like USDT.

- Global Reach: Tether has a widespread presence, making it accessible to users across the globe. Its compatibility with various blockchain networks, including Ethereum and Tron, extends its usability.

- Regulatory Environment: Tether has managed to navigate the complex regulatory environment of cryptocurrencies, often addressing concerns about transparency and regulatory compliance. This has fostered trust among users.

Controversies and Criticisms

While Tether’s rise has been meteoric, it has not been without its share of controversies and criticisms. Some of the key concerns include:

- Lack of Transparency: Tether’s operator, Tether Limited, has faced scrutiny regarding its claims of backing every USDT with an equivalent amount of US dollars. Critics argue that the company has not provided sufficient evidence to validate these claims.

- Regulatory Scrutiny: Tether has faced investigations from regulatory authorities, including the New York Attorney General’s office. These investigations have prompted questions about its operational transparency and adherence to regulations.

- Market Manipulation Concerns: There have been allegations that Tether issuance is linked to market manipulation, particularly during bull runs. Critics contend that the sudden issuance of USDT can inflate cryptocurrency prices artificially.

- Alternative Stablecoins: As the stablecoin market expands, Tether faces increased competition from other stablecoins that offer more transparent reserves and regulatory compliance. These alternatives may challenge Tether’s dominance.

The Tether Ecosystem

Beyond the simple USDT token, Tether Limited has expanded its offering to include other stablecoins. These include:

- USDC (USD Coin): Launched as a joint effort with Circle, USDC is a stablecoin that has gained recognition for its transparency and regulatory compliance.

- EURT (Euro Tether): In response to growing demand for stablecoins beyond the US dollar, Tether Limited introduced the Euro Tether, offering the same stability as USDT but pegged to the euro.

- CNHT (Chinese Yuan Tether): CNHT is a stablecoin pegged to the Chinese yuan, intended to provide a stable value for users trading in the Chinese market.

The Future of Tether

As Tether continues to play a pivotal role in the cryptocurrency ecosystem, its future remains closely intertwined with ongoing regulatory developments. Regulatory clarity, or the lack thereof, can significantly impact Tether’s operations and acceptance.

Tether Limited has made strides in enhancing transparency, publishing quarterly reports on its reserve holdings. However, concerns about its reserves’ composition and regulatory compliance persist. These challenges underscore the delicate balancing act Tether faces as it navigates an ever-evolving crypto landscape, where both innovation and scrutiny are the defining forces.

The Wrap-Up

In conclusion, Tether’s prominence in the crypto world cannot be denied. Its role as a stablecoin and a liquidity provider has made it a cornerstone of the cryptocurrency market. Despite the controversies and challenges it faces, Tether remains a dominant force in the crypto world, influencing trading strategies and providing a haven of stability in a volatile digital landscape. The future of Tether will undoubtedly be shaped by regulatory developments and the evolving dynamics of the crypto market.