How the US Economy in 2025 Could Affect Your Portfolio

The US economy is always full of surprises, and 2025 is shaping up to be no exception. From interest rate policies to employment trends, the economy’s direction can significantly impact your investments. It’s worth taking a closer look to understand what’s happening and how you can prepare your portfolio.

The Market Moves You Should Be Watching

A key consideration in 2025 will be the Federal Reserve’s decisions on interest rates. Historically, when rates go up, borrowing becomes more expensive, which can cool business growth and impact the stock market.

On the other hand, reduced interest rates typically encourage borrowing, which can, in turn, stimulate economic activity. But this year, the Fed has been walking a tightrope, attempting to balance economic recovery while keeping inflation in check, and that uncertainty can ripple through your financial decisions.

For those involved in trading, tools like short futures are gaining attention in this kind of unpredictable environment. Short futures allow investors to benefit from a drop in the price of an asset, providing a hedge against market downturns.

While this strategy isn’t for everyone, it’s become more appealing to those who want to protect their portfolios from unexpected volatility. It’s just one of the mechanisms people are turning to as they anticipate shifts in the economy this year.

Inflation’s Impact on Purchasing Power

Inflation has been the buzzword for several years, and 2025 is proving no different. Even at modest levels, inflation erodes the value of your money over time. For instance, the $50 bill in your wallet today likely won’t buy you the same items a year from now.

This loss of purchasing power hits retirees particularly hard, as they rely on fixed incomes or savings to meet their financial needs. Investments that don’t outpace inflation could lose value in real terms, which is why keeping tabs on inflation is crucial.

Commodities and real assets, like gold or real estate, have historically acted as hedges against inflation. This year, however, the narrative might shift toward sectors like technology and renewable energy, which appear better positioned to ride out economic changes. If your portfolio is skewed toward cash or low-yield bonds, it might be time to reassess and make inflation-resilient adjustments.

The Role of Consumer Spending

Consumer spending accounts for more than two-thirds of the US economy, and in 2025, Americans’ wallets could still determine where the markets head. Employment rates, wage growth, and even pandemic-related savings are all factors influencing spending trends this year. If consumers feel confident, they spend more, potentially boosting retail, hospitality, and e-commerce sectors. If they tighten their belts, though, you might see drops in revenue for those industries.

What does this mean for your portfolio? Companies reliant on discretionary spending may take a hit if consumers cut back. On the other hand, essential goods and services, utilities, and even healthcare investments may stay strong since people continue to rely on these regardless of economic conditions. Diversifying your portfolio to balance these dynamics could help mitigate risk.

Technology and Innovation are Reshaping Sectors

Big tech breakthroughs are changing the economy in major ways, with industries like AI, renewable energy, and electric vehicles (EVs) continuing to boom. For tech-savvy investors, this is a space to watch. The government’s focus on green energy initiatives and the ongoing rollouts of futuristic technologies are keeping these industries in the spotlight.

For instance, the EV market is evolving beyond the dominance of early players like Tesla, with traditional carmakers now investing heavily in the space. Meanwhile, AI applications are seeping into everything from marketing to healthcare, creating opportunities for innovative startups and established companies alike. If your portfolio has lagged behind these technological trends, 2025 could be the year to start aligning with the future.

How Global Events Tie into the Equation

While we’ve talked mostly about domestic factors, international events matter too. Global supply chains are still in recovery mode, and geopolitical tensions continue to weigh on international trade. These factors can heavily influence industries that rely on imports or have significant overseas exposure.

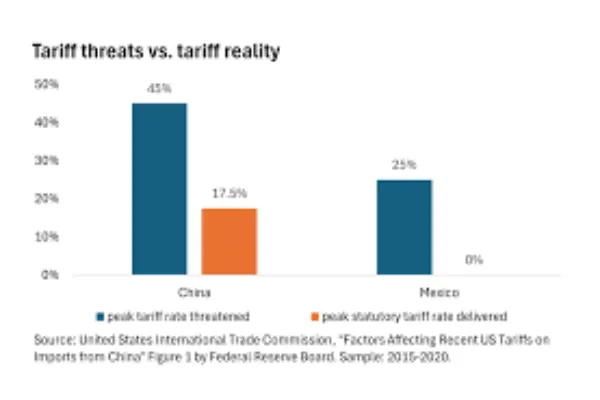

For example, the semiconductor industry remains vulnerable to disruptions in East Asia, which is a crucial hub for production. Add in fluctuating currency values and potential trade tariffs, and it becomes clear why many investors are paying closer attention to domestic-centric stocks in 2025. However, betting on global markets can also offer diversification benefits, balancing risks with opportunities.