Forex Market vs Shares Trading: Basic Lifehacks for Beginner Traders

Once you pick your trading direction, precision and timing become your constant companions. So, how to stay ahead of the curve in a multi-faceted landscape where innovative selling strategies pop up like mushrooms in the rain? Both Forex and stock trading stand out with diverse benefits for potential traders. Let’s delve further into the matter.

Forex trading and shares trading are the most popular assets for day trading, long-term, and medium-term investing in the universe of endless choices. For instance, the daily turnover volume on Forex is more than $5 trillion, while the total market capitalization of all world stocks is more than $63 trillion.

Forex and Stocks in Brief

Let’s immediately define that Forex is a versatile market where interested individuals exchange one foreign currency for another online at the rate of the largest global over-the-counter (OTC) participants. This market is so liquid and global that it is not tied to specific exchanges. Opening transactions in the virtual space is faster and more profitable than at an exchange office near your home.

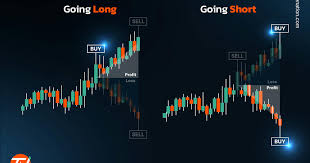

In turn, stocks represent shares of publicly traded enterprises. When you purchase shares, you become a shareholder in the company and have a claim on a portion of its corporate profits. Moreover, if you buy contracts for difference (CFDs) instead of stocks themselves, you do get the chance to profit from changes in their value. This sounds particularly alluring to investors who focus on short-term price changes and do not plan to go long-term.

What Affects Prices: Forex vs. Stocks

Both markets are impacted by a great variety of factors. In the Forex market, core drivers encompass economic data such as inflation, employment, and manufacturing.

The key triggers for currency movements are interest rate decisions by central banks such as the Federal Reserve, the Bank of England, and the European Central Bank (ECB). Certain currencies may also hinge on the prices of key commodities like oil or gas.

In turn, stocks are drastically affected by a bulk of reasons, including corporate earnings, M&A activity, monetary and fiscal policies, and company-specific news.

Handy Tips To Trade Forex Effectively

The vast majority of Forex traders make no profit at all, which is a sad reality. Nevertheless, many can significantly increase their chances of success if they follow these straightforward tips:

- Start with a demo account. If you are new to trading, do not risk your funds right away. Practice on a demo account for a few months; if you are eager to start quickly, practice for a few weeks minimum.

- Take the time to look for a broker. Selecting a Forex broker is a decision that does not tolerate haste. There are many options here, each with strengths and weaknesses. You can afford to be picky.

- Make sure you know your trading platform inside and out. Your trading platform is vital for placing orders and trading. Knowing exactly how it works is crucial.

- Stick to your strategy. A reliable, thoroughly tested strategy is a prerequisite for successful work. Avoid deviating from your strategy, even if such a deviation looks quite tempting.

- Prioritize Risk Management. Make sure you establish a solid risk management strategy. For example, you may decide that you can risk 2% of your total account balance on a single trade and consider moving your stop order to breakeven once the trade is greater than 1%.

- Stay humble. It’s easy to become overconfident when you have a long string of successful trades under your belt. This can easily make you feel invincible and start making rash, impulsive decisions. Remember, you are a small fish in a big pond when trading Forex.

Basic Lifehacks: How to Trade Shares Efficiently

- Invest gradually across diverse stocks. Rather than investing a large sum in one stock, consider buying a smaller amount in various sectors. Too much diversification can lead to poor profit and loss.

- Don’t invest all your money at once. Leave some cash on hand to buy more shares afterward if they drop sharply.

- Don’t give in to the herd instinct. Just because everyone is rushing to buy a particular stock does not mean it is the right time for you to invest.

- Avoid subscribing to bizarre social media groups. There is no point in subscribing to paid channels that promise to send “signals” of what exactly to buy. In the worst case, you will lose on risky transactions.

- You are not recommended to trade with leverage. Trading with leverage can magnify risks. If the leverage is big, you risk burning out instantly, much like in gambling.

- Consider long-term holds for first-time trading. If you are trading for the initial time, buy a bunch of shares and hold onto them for at least six months. While their prices may fluctuate in the short term, they are likely to stabilize over time.

Conclusions

Ultimately, Forex trading is considered more profitable than the stock market; however, share trading can make you well-off in the blink of an eye. Whether you are a newbie or already in the game, consider potential perks and pitfalls before choosing your preferred option.